The sudden market crash in the crypto space liquidated many traders — and according to data shown on the blockchain, the attackers responsible for the infamous BNB Chain exploit which led to the theft of almost $600 million worth of BNB tokens.

On Oct. 6, the cross-chain bridge by blockchain network BNB Chain was suspended because of an exploit that allowed the hackers to make off with 2 million BNB tokens, which were worth around $568 million at the time of the theft.

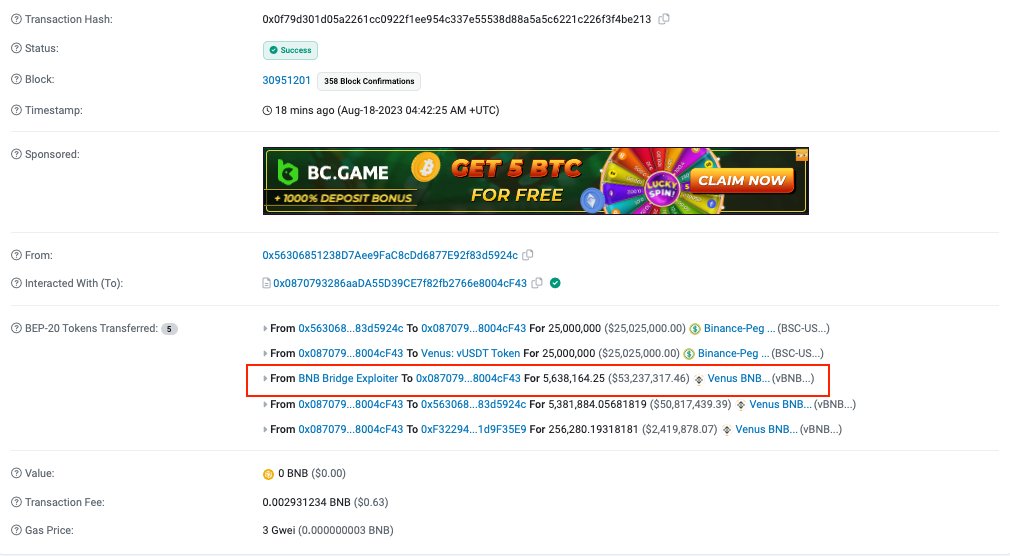

On Aug. 18, a crypto wallet linked to the exploit had its collateral, worth more than $53 million, liquidated on the crypto lending platform Venus Protocol, according to blockchain security firm PeckShield. The hacker apparently used the tokens as collateral for a $30 million Tether (USDT) loan on the protocol.

On Aug. 18, the entire crypto market suffered a 6% drop, sending the overall market capitalization to $1.1 trillion, according to coin information sites. The event wiped out over $1 billion in crypto positions in the last 24 hours according to market data tracker Coinglass.

The BNB chain hackers were also affected as the price of BNB dropped below $220. According to blockchain data, three positions linked to the wallet were automatically liquidated after the price fell. At the moment, BNB trades at $218 per token.

While many suffered losses as a result of the massive drop in the market, some were able to minimize the damage. Days before the crash, a crypto whale sold 22,341 Ether, worth around $41 million, and avoided a potential loss of over $5 million in value. Despite this, the crypto trader still lost around $1.7 million in the trade.

Copyright © 2021-2024 AssessCrypto All rights reserved.